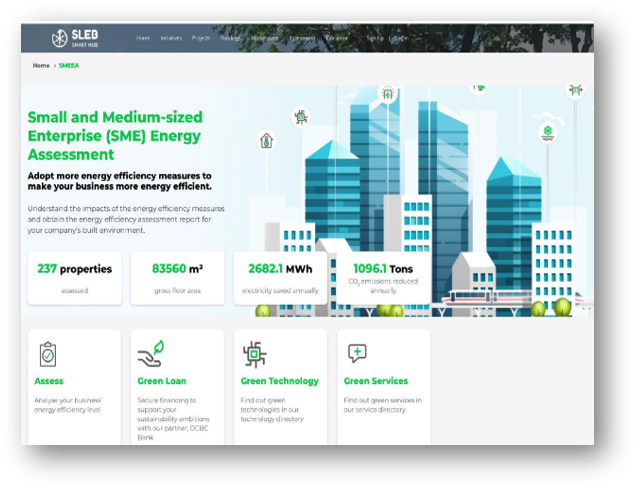

A no-cost SME Energy Efficient Assessment (SMEEA) tool that helps SMEs reduce emissions and connects them to sustainable financing and green building certifications.

Environmental challenge

OCBC believes in the importance of an inclusive transition for the economy, which includes small and medium-sized enterprises (SMEs). The company understands the needs of businesses and recognises current gaps in the market, where some sustainability solutions and services are inaccessible to SMEs due to their complexity and cost.

In partnership with Singapore’s Building and Construction Authority (BCA), OCBC has developed the SME Energy Efficient Assessment (SMEEA) tool, which it has taken regional, providing a fast, free and easy-to-use online self-assessment tool to help SMEs measure the energy efficiency of their buildings, allowing the company to optimise energy use and access green financing options.

Purpose and strategy

OCBC’s purpose is to "enable people and communities to realise their aspirations," and this mission is at the heart of the SMEEA project. Recognising the challenges SMEs face in their sustainability journey, OCBC is committed to creating long-term, lasting value for its clients through business engagement, development of innovative tools and financing solutions.

The SMEEA tool allows SMEs to understand their energy consumption and its impact better, providing them with actionable insights into green building technologies. The tool supports SMEs in Singapore, Indonesia, Malaysia and Hong Kong, tailored to local market norms and climatic conditions. It enables SMEs across the region to access certification and green finance for a wider array of business types, including simple structures like small warehouses and shophouses.

Impact and innovation

Since its launch, SMEEA has significantly impacted SMEs across Singapore and the region. More than 500 SMEs are engaged with the tool and more than 1000 properties have been assessed.

In 2023, OCBC’s sustainable financing commitments grew by 26% to SGD56 billion and more than 1,200 SMEs have benefited from our sustainable finance offerings. The tool has proven instrumental in bridging the gap between SMEs and large-scale sustainability initiatives, offering green building certifications for businesses that established schemes like BCA Green Mark or LEED do not currently cater for. As SMEs become increasingly aware of their energy use and optimisation strategies, SMEEA plays a vital role in helping them take the first steps to transition to a low-carbon future.

Future outlook

Looking ahead, OCBC plans to embed SMEEA assessments into every commercial property loan and refinancing of property loans for SMEs, ensuring broader awareness across its client base. OCBC’s commitment to sustainability extends beyond immediate financial returns and as such, it is focused on actively empowering businesses to reduce emissions and improve environmental performance to remain viable and relevant for now and beyond.

In the long term, OCBC will continue to develop educational materials and processes to enhance the understanding and use of SMEEA among its clients and bankers, supporting the financial sector’s role in driving climate action across the region.

OCBC is setting a new standard for SME engagement in sustainability, with SMEEA at the forefront of this effort. Through innovation, collaboration, and a deep understanding of its clients' needs, OCBC is empowering SMEs to take tangible steps toward a greener, more sustainable future.